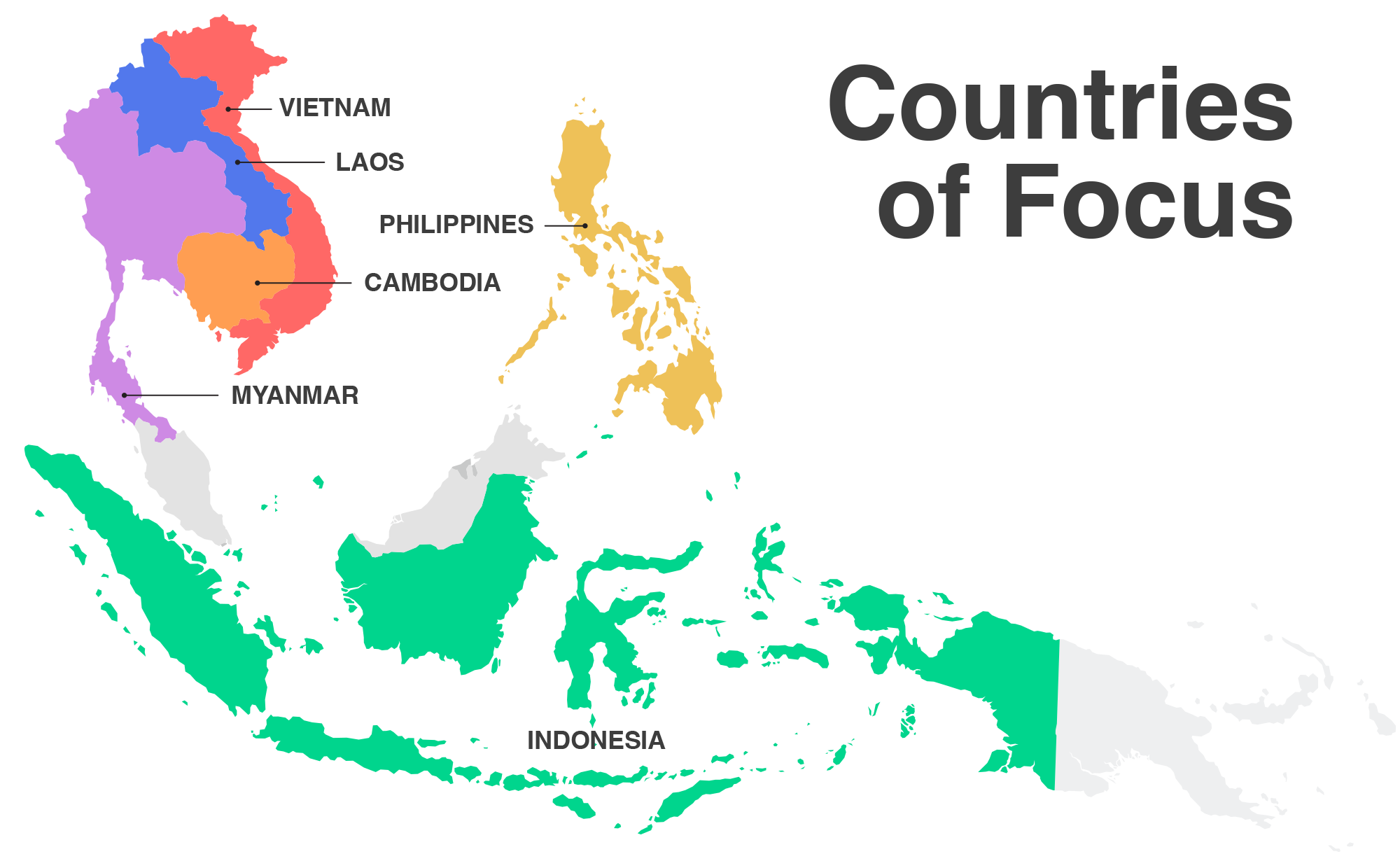

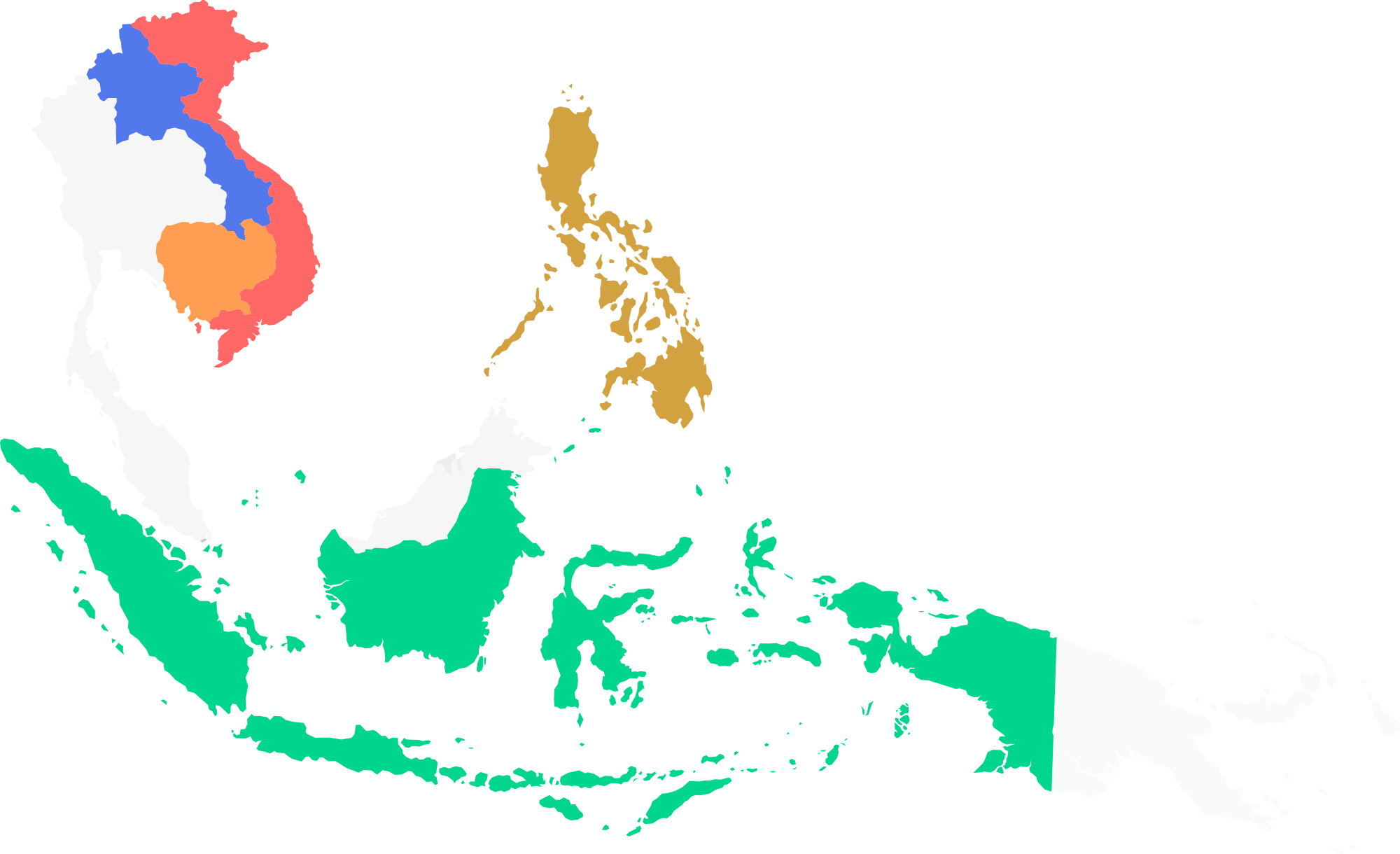

Our Work in Southeast Asia

Home to some 700 million people, Southeast Asia is one of the most diverse regions in the world–ethnically, religiously, linguistically, politically, socio-economically. It includes advanced economies such as Singapore and Malaysia, newly industrialized Indonesia, and developing countries such as Cambodia, Laos, and Myanmar. With generous support from the government of Luxembourg, Cerise+SPTF has been working since 2018 to advance better financial services in the region.

The Responsible Inclusive Finance Facility in Southeast Asia (RIFF-SEA) works to advance social and environmental performance management (SEPM) practices in the region. Through co-financing and training activities, RIFF-SEA has increased local consultants’ capacity for SEPM, raised awareness about SEPM among regulators and investors, and helped financial service providers better understand the importance of SEPM, assess their practices, and improve their performance—all with the goal of ensuring that financial services protect and benefit low-income Souheast Asian clients.

The COVID-19 pandemic, the corresponding push to digital, and an evolving industry have made such client-centricity more vital than ever. SEPM strengthened institutions’ commitment to clients during COVID, and it will have to be an integral part of the industry’s recovery to ensure low-income clients are protected. Meanwhile, as financial service providers increasingly move to digital, low-income clients risk being left behind without a deliberate focus on serving them responsibly.

RIFF-SEA’s goal is to advance the social performance management practices of financial service providers serving low-income clients in Southeast Asia so that the region’s financial systems will include, protect, and benefit these clients.

RIFF-SEA Activities

Formations

- Introductory training on responsible inclusive finance

- Training of client protection assessors

- Training of SPI5 / SPI Online auditors

- Training technical assistance (TA) providers on client protection

- Training TA providers on other aspects of social and environmental performance management (SEPM)

- Training regulators on SEPM

Co-Financing Activities

- SPI5 / SPI Online audit plus additional support

- Évaluation de la protection des clients

- Évaluation de la préparation numérique

- Upgrade project chosen by the provider

- Formation spécialisée sur un aspect précis de la GPSE pour une institution financière

- L'évaluation sociale

Select Past Projects

Audits & Action Plans

Lao Microfinance Association

Measuring social outcomes

ECLOF Philippines

Better Tech to Serve the Rural

ACE Vietnam

Financial Literacy E-Learning App

Monkiri

Customer hotline

YCAB Ventures

Digital Readiness Assessment

CAMMA Microfinance

Actualités du Cambodge

"Nous ne pouvons pas forcer la volonté".

Le journal britannique The Guardian a publié un article le 23rd octobre 2023, détaillant des suicides récents parmi les résidents autochtones de la province cambodgienne de Ratanakiri. Ils sont tous clients de la microfinance et décrits comme souffrant d'une intense détresse psychologique en raison du surendettement. Cerise+SPTF a été citée (à juste titre) car décrivant le surendettement des clients et les pratiques de recouvrement abusives comme des violations de nos normes de protection des clients. Nous avons également demandé aux organismes de certification de réexaminer les certifications en matière de protection des clients des institutions citées parmi les contrevenants.

Parmi les nombreux points importants soulevés par The Guardian nous aimerions en souligner deux. Tout d'abord, le leadership qui est important. Notre expérience (à travers le monde et depuis plus de 20 ans) nous a appris que dans chaque institution, l'engagement en faveur de la protection des clients vient du plus haut niveau ou n'existe pas du tout. Au Cambodge, nous avons organisé des séances d'information intensives de haute facture à l'intention des PDG et des conseils d'administration de toutes les grands institutions financières. La participation de ces dernières avait été imposée par les autorités de réglementation. Depuis le lancement de cette initiative en juin 2023, nous avons sensibilisé plus de 300 cadres supérieurs et actionnaires. L'accent mis sur le leadership est particulièrement pertinent sur un marché de la microfinance comme celui du Cambodge où, comme le décrit l'article, des institutions de microfinance de premier plan, fondées à l'origine par des investisseurs et des dirigeants soucieux de leur impact, sont vendues à des "maximiseurs de profit", dont la plupart ont leur siège en dehors du pays.

Deuxièmement, la dette de la microfinance n'est qu'un élément du surendettement. Les clients surendettés de l'industrie doivent généralement de l'argent non seulement à leurs prestataires de microfinance, mais aussi à des prêteurs informels non agréés et non réglementés (diversement décrits comme des prêteurs d'argent, des prêteurs de quartier ou des usuriers). Comme The Guardian l'a décrit, même si les institutions de microfinance restructurent ou annulent les prêts accordés à ceux qui ne peuvent pas rembourser, les usuriers, eux, ne le font pas. Pour éviter de pousser des clients désespérés et déjà surendettés dans les bras des usuriers, les institutions financières formalisées ont l'obligation morale, urgente, de se comporter de manière responsable. Elles doivent procéder à une présélection rigoureuse et à une analyse des flux de trésorerie de leurs clients à faibles revenus, même si (surtout si) cette analyse est plus difficile à réaliser pour les clients dont la tenue des dossiers n'est pas des plus régulière. Plus important encore, les agents de crédit doivent être en mesure de refuser des clients non qualifiés sans se soucier des objectifs de vente. Cela signifie évidemment que les dirigeants de l'institution doivent fonder leurs attentes en matière de croissance et de bénéfices sur ce qui est sain et, d'un point de vue financier, doivent faire savoir, verbalement et en actes, que le personnel en contact avec la clientèle ne sera pas pénalisé pour une production plus faible. Enfin, les institutions doivent accepter que même des clients soigneusement sélectionnés puissent se retrouver dans une situation inextricable et travailler avec eux pour restructurer leurs prêts lorsque cela se produit.

Si nous ne pensons pas que le surendettement puisse jamais être éliminé, nous sommes convaincus qu'il peut être considérablement réduit si les institutions financières respectent l'esprit, et pas seulement les écrits, des lois et des politiques relatives à la protection des clients. Notre message aux acteurs cambodgiens qui essaient sincèrement de faire le bien est de résister à la tentation d'abandonner et de trouver des marchés plus faciles pour travailler, et au contraire de rester pour aider à résoudre les problèmes.

Toutefois les institutions financières ne sont pas les seules qui doivent agir. Au Cambodge comme ailleurs, tous les acteurs du marché doivent jouer leur rôle. Trop d'emprunts sont contractés pour répondre à des besoins fondamentaux ou à des situations d'urgence. Selon le contexte (cela peut ne pas être pertinent dans de nombreux pays en développement), lorsqu'il existe des filets de sécurité sociale, les personnes qui ont besoin de subventions et d'une aide directe devraient y avoir accès plutôt que d'emprunter.

Pour conclure, les clients eux-mêmes doivent savoir quel niveau d'emprunt, le cas échéant, est le mieux pour eux. Ils doivent également avoir la discipline de dire non à tout ce qui dépasse ce niveau. Ni la connaissance, ni la discipline ne sont nécessairement faciles à acquérir. Aux Philippines, l'association nationale de microfinance a mené l'année dernière un essai pilote de formation intensive en matière d'éducation financière à l'intention des clients potentiels de la microfinance. Cette formation, dispensée par des contractants tiers, a permis aux participants de découvrir les conditions des différents produits de prêt ainsi que les usages et les abus du crédit. À l'issue de la formation, la moitié des clients potentiels ont finalement décidé de ne pas contracter de prêt.

Notre message aux acteurs cambodgiens qui essaient sincèrement de faire le bien, est le suivant : résistez à la tentation d'abandonner et de trouver des marchés plus faciles pour travailler, restez pour aider à résoudre les problèmes.

En tant que réseau mondial de l'industrie travaillant sur la finance inclusive responsable, Cerise+SPTF travaille au niveau des systèmes de marché.Nous nous engageons non seulement auprès des institutions financières, mais aussi auprès des régulateurs qui les supervisent, des investisseurs qui les financent, des organismes de protection des consommateurs et de toutes les autres parties prenantes qui s'intéressent au bien-être financier des populations à faibles revenus. Nous disposons de dizaines d'années d'expérience, acquise à travers le monde, sur ce qui fonctionne et ce qui ne fonctionne pas en matière de protection des clients. Nous disposons d'un large éventail d'outils et de ressources. Nous pouvons aider les différentes parties prenantes à élaborer des politiques efficaces. Nous pouvons guider la mise en œuvre. Cependant, nous ne pouvons pas forcer la volonté.

Au final, notre travail n'est pas destiné à ceux qui en ont besoin. Il est destiné à ceux qui le veulent.

Nous tenons à remercier The Guardian⠀et le journaliste Jack Brook, pour avoir mis en lumière les coûts humains des prêts irresponsables. Nous espérons qu'il incitera de nombreuses autres parties prenantes à s'engager, sérieusement et passionnément, en faveur de la protection des clients. Cerise+SPTF fera plus que la moitié du chemin.

Other Activities in the Region

Along with the co-financing and capacity-building work RIFF-SEA does with individual institutions, Cerise+SPTF works at the market-systems level in our countries of operation throughout Southeast Asia. We have worked with the Philippines to ensure that social performance management principles are incorporated into the regulations governing microfinance providers. In Cambodia, we are working closely with the regulators, Cambodian Microfinance Association, Association of Banks in Cambodia, and other stakeholders to urgently address issues of client protection.

Safe Finance program for clients

L'étude market-systems approach we take to our work means that Cerise+SPTF works with all the major stakeholder groups who work with microfinance clients. We also seek to influence the behaviors of clients themselves—especially ensuring that they not only know they have multiple avenues of recourse if subjected to abusive practices, but more importantly, feel empowered and unafraid to use them. Cerise+SPTF worked with Cambodian Microfinance Association, Association of Banks in Cambodia, and the National Bank of Cambodia to design the Safe Finance program, being piloted through 2024 in select markets, and are supporting the Association and the regulator on its implementation.Client protection workshop for CEOs

Given our strong belief that commitment to client protection comes from the top or not at all, Cerise+SPTF has been conducting high-level briefings on client protection in Cambodia. These briefings are mandatory: the National Bank of Cambodia requires all top leadership to attend as part of its response to troubling signs of over-indebtedness and other risks to clients in the Cambodian market. Since this effort was launched in June 2023, we have briefed more than 220 top executives and shareholders. Cerise+SPTF will lead eight sessions in total to reach the shareholders and CEOs of every major financial service provider in Cambodia, including the largest commercial banks. These briefings are not auditorium-style lectures: they are intensive, small-group engagements.RIFF-SEA News

Press Releases

January 2023

Cerise+SPTF delivers a training in Vientiane, Laos for senior managers of financial institutions, under the patronage of H.R.H. the Grand Duke of Luxembourg and with the participation of Minister for Development Cooperation and Humanitarian Affairs, M. Franz Fayot.