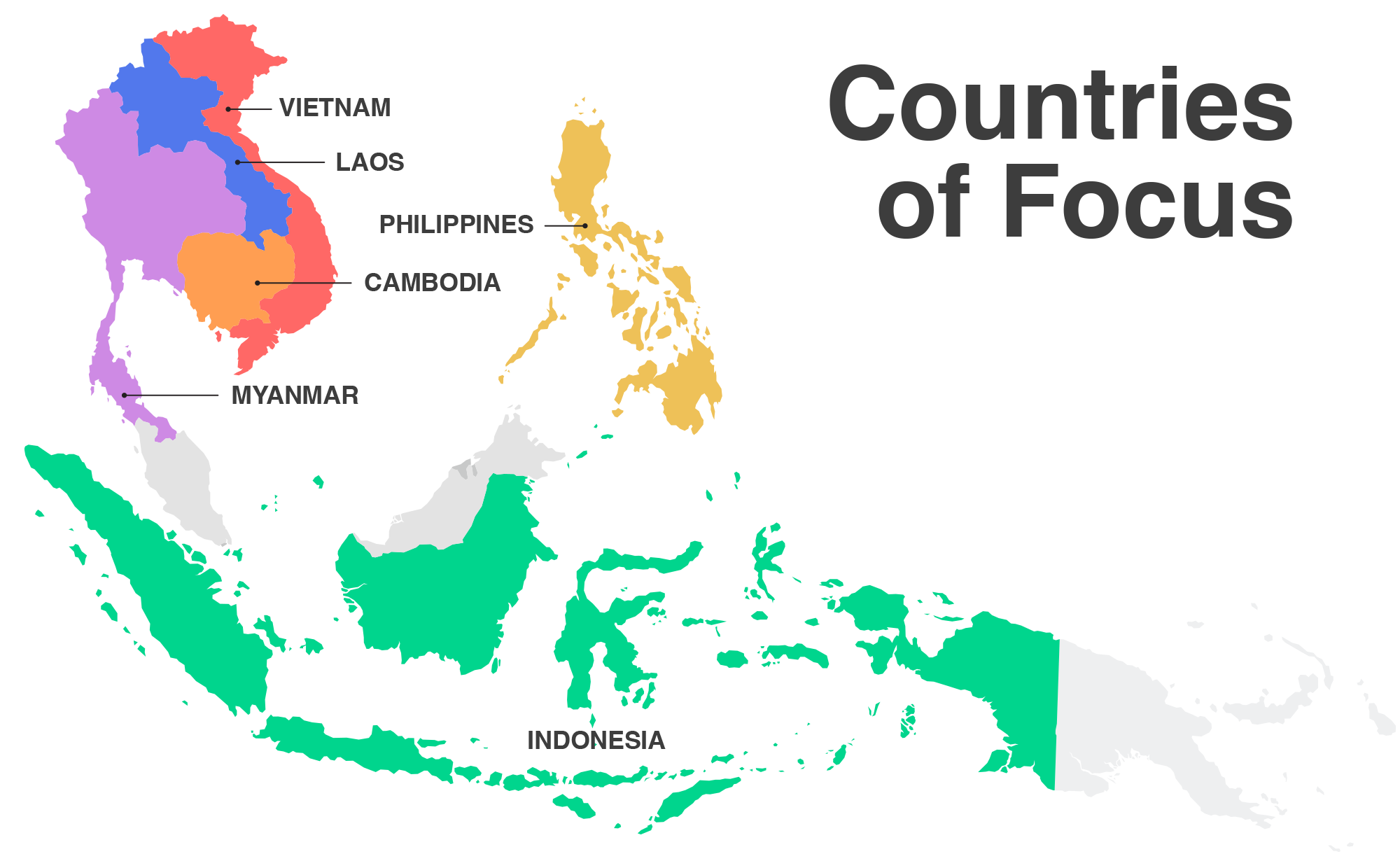

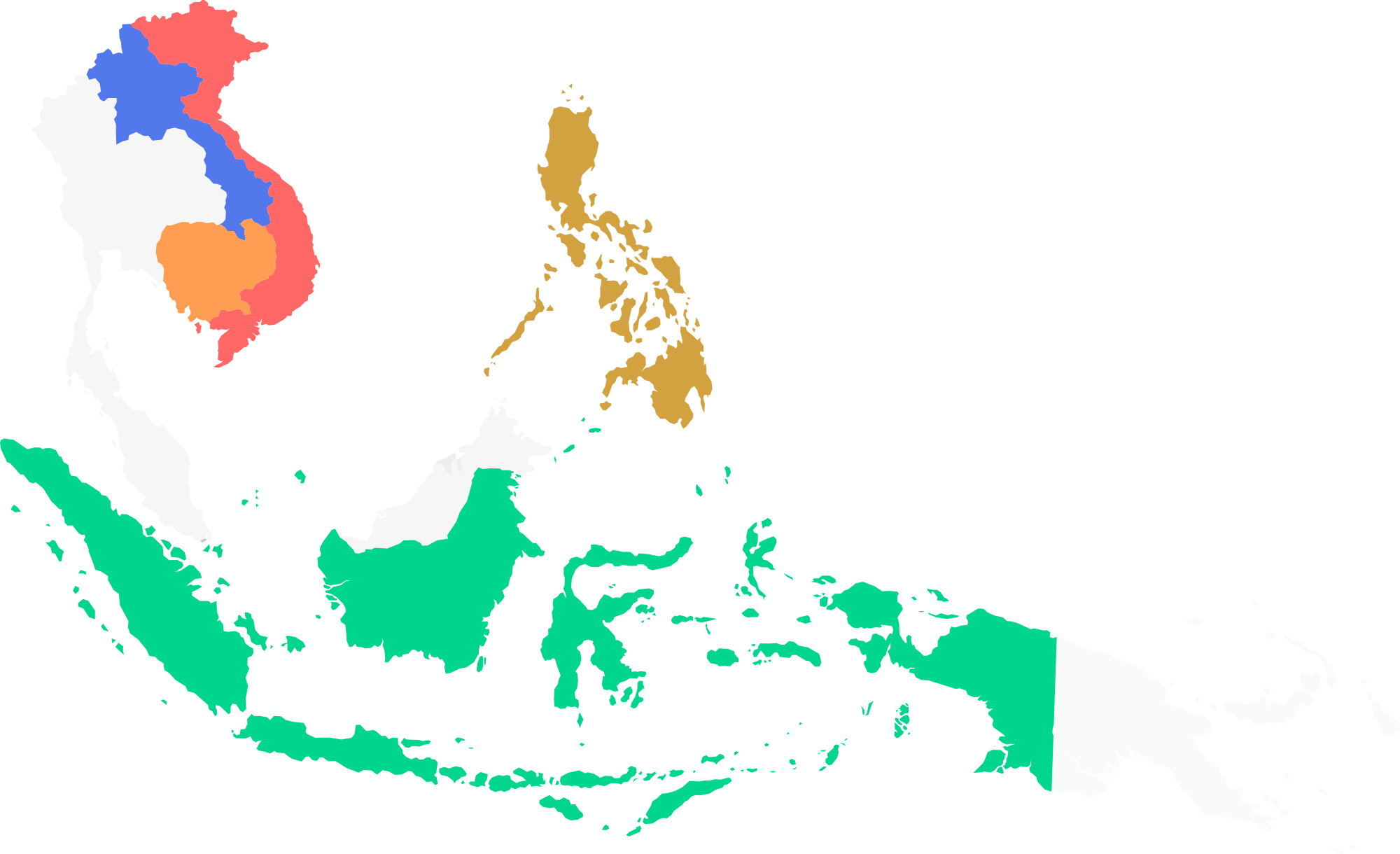

Our Work in Southeast Asia

Home to some 700 million people, Southeast Asia is one of the most diverse regions in the world–ethnically, religiously, linguistically, politically, socio-economically. It includes advanced economies such as Singapore and Malaysia, newly industrialized Indonesia, and developing countries such as Cambodia, Laos, and Myanmar. With generous support from the government of Luxembourg, Cerise+SPTF has been working since 2018 to advance better financial services in the region.

The Responsible Inclusive Finance Facility in Southeast Asia (RIFF-SEA) works to advance social and environmental performance management (SEPM) practices in the region. Through co-financing and training activities, RIFF-SEA has increased local consultants’ capacity for SEPM, raised awareness about SEPM among regulators and investors, and helped financial service providers better understand the importance of SEPM, assess their practices, and improve their performance—all with the goal of ensuring that financial services protect and benefit low-income Souheast Asian clients.

The COVID-19 pandemic, the corresponding push to digital, and an evolving industry have made such client-centricity more vital than ever. SEPM strengthened institutions’ commitment to clients during COVID, and it will have to be an integral part of the industry’s recovery to ensure low-income clients are protected. Meanwhile, as financial service providers increasingly move to digital, low-income clients risk being left behind without a deliberate focus on serving them responsibly.

RIFF-SEA’s goal is to advance the social performance management practices of financial service providers serving low-income clients in Southeast Asia so that the region’s financial systems will include, protect, and benefit these clients.

RIFF-SEA Activities

Trainings

- Introductory training on responsible inclusive finance

- Training of client protection assessors

- Training of SPI5 / SPI Online auditors

- Training technical assistance (TA) providers on client protection

- Training TA providers on other aspects of social and environmental performance management (SEPM)

- Training regulators on SEPM

Co-Financing Activities

- SPI5 / SPI Online audit plus additional support

- Client protection assessment

- Digital readiness assessment

- Upgrade project chosen by the provider

- Specialized training for the provider on an aspect of SEPM of its choosing

- Social Rating

Select Past Projects

Audits & Action Plans

Lao Microfinance Association

Measuring social outcomes

ECLOF Philippines

Better Tech to Serve the Rural

ACE Vietnam

Financial Literacy E-Learning App

Monkiri

Customer hotline

YCAB Ventures

Digital Readiness Assessment

CAMMA Microfinance

News from Cambodia

“We can’t force willingness.”

The U.K.-based publication The Guardian published an article on 23rd October detailing recent suicides among indigenous residents of the Cambodian province of Ratanakiri, all of whom had been microfinance clients and were described as suffering intense psychological distress as a result of over-indebtedness. Cerise+SPTF was quoted (accurately) describing the over-indebting of clients and abusive collections practices as violations of our Client Protection Standards. We also requested the certifying bodies to place under review the client protection certifications of those institutions which were named among the violators.

Among the many important points raised by The Guardian article, there are two we would like to highlight. First, leadership matters. Our experience—all over the world and for more than 20 years—has taught us that in every institution, the commitment to client protection comes from the very top or not at all. In Cambodia, we have been conducting intensive high-level briefings for the CEOs and boards of every major financial service provider, attendance at which has been mandated by the regulators. Since the effort launched in June, we have briefed more than 300 top executives and shareholders. This focus on leadership is especially relevant in a microfinance market like Cambodia’s in which, as the article describes, prominent microfinance institutions, originally founded by purpose-driven impact investors and executives, are being sold off to profit maximizers, many of which are headquartered outside the country.

Second, microfinance debt is just one piece of over-indebtedness. Over-indebted microfinance clients usually owe money not just to their microfinance providers but also to unlicensed, unregulated informal lenders (variously described as moneylenders, local neighborhood lenders, or loan sharks). As The Guardian article describes, even if microfinance institutions will restructure or forgive loans for those who cannot repay, loan sharks will not. To avoid driving desperate, already over-indebted clients into the arms of loan sharks, formal financial service providers have an urgent moral obligation to behave responsibly. They must perform rigorous prequalification and cash-flow analysis of their low-income clients, even if (especially if) that analysis is harder to conduct for clients whose record-keeping is not the strongest. More important, the credit officers must be able to turn down unqualified clients without worrying about sales targets. This of course means, again, that the institution’s leadership must base its growth and profit expectations around what’s healthy and—crucially—must communicate in words and actions that client-facing staff will not be penalized for lower production. Finally, providers must accept that even carefully screened clients can get in over their heads, and work with such clients to restructure loans when that happens.

While we do not believe that over-indebtedness can ever be eliminated, we are convinced it can be greatly reduced if financial service providers embrace the spirit, not just the letter, of the laws and policies around client protection. Our message to the players in Cambodia who are sincerely trying to do good is to resist the temptation to give up and find easier markets to work in, and instead to stay and help clean up the problems.

But financial service providers are not the whole story, in Cambodia or anywhere else—all market actors must play their roles. Too much borrowing is done to meet basic needs or respond to emergencies. Depending on the context (this may not be relevant in many developing countries), where social safety nets do exist, people who need grants and direct relief should access those instead of borrowing.

Finally, clients themselves must know what level of borrowing, if any, is a good idea for them and must also possess the discipline to say No to anything more than that. Neither one of those things—the knowledge or the discipline—is necessarily easy. In the Philippines, the national microfinance association ran a pilot test last year for intensive financial literacy training to be delivered among potential microfinance clients. The training, delivered by third-party contractors, walked the participants through the terms and conditions of various loan products and through the uses and misuses of credit. At the end of the training, fully half of the would-be clients decided not to take loans after all.

Our message to the players in Cambodia who are sincerely trying to do good is: Resist the temptation to give up and find easier markets to work in, and instead stay and help clean up the problems.

As the global industry network working on responsible inclusive finance, Cerise+SPTF works at the market systems level, engaging not just with financial service providers but with the regulators who oversee them, the investors who fund them, the consumer protection entities, and all other stakeholders with an interest in the financial wellbeing of low-income populations. We have decades of experience, from all over the world, about what works and what doesn’t in client protection. We have an array of tools and resources. We can help different stakeholders craft effective policy. We can guide implementation. But we cannot force willingness.

Ultimately our work is not for those who need it. It is for those who want it.

We are grateful to The Guardian, and to reporter Jack Brook, for highlighting the human costs of irresponsible lending. We hope it will move many more stakeholders to commit—seriously and passionately—to client protection. Cerise+SPTF will meet you more than halfway.

Other Activities in the Region

Along with the co-financing and capacity-building work RIFF-SEA does with individual institutions, Cerise+SPTF works at the market-systems level in our countries of operation throughout Southeast Asia. We have worked with the Philippines to ensure that social performance management principles are incorporated into the regulations governing microfinance providers. In Cambodia, we are working closely with the regulators, Cambodian Microfinance Association, Association of Banks in Cambodia, and other stakeholders to urgently address issues of client protection.

Safe Finance program for clients

The market-systems approach we take to our work means that Cerise+SPTF works with all the major stakeholder groups who work with microfinance clients. We also seek to influence the behaviors of clients themselves—especially ensuring that they not only know they have multiple avenues of recourse if subjected to abusive practices, but more importantly, feel empowered and unafraid to use them. Cerise+SPTF worked with Cambodian Microfinance Association, Association of Banks in Cambodia, and the National Bank of Cambodia to design the Safe Finance program, being piloted through 2024 in select markets, and are supporting the Association and the regulator on its implementation.Client protection workshop for CEOs

Given our strong belief that commitment to client protection comes from the top or not at all, Cerise+SPTF has been conducting high-level briefings on client protection in Cambodia. These briefings are mandatory: the National Bank of Cambodia requires all top leadership to attend as part of its response to troubling signs of over-indebtedness and other risks to clients in the Cambodian market. Since this effort was launched in June 2023, we have briefed more than 220 top executives and shareholders. Cerise+SPTF will lead eight sessions in total to reach the shareholders and CEOs of every major financial service provider in Cambodia, including the largest commercial banks. These briefings are not auditorium-style lectures: they are intensive, small-group engagements.RIFF-SEA News

Press Releases

January 2023

Cerise+SPTF delivers a training in Vientiane, Laos for senior managers of financial institutions, under the patronage of H.R.H. the Grand Duke of Luxembourg and with the participation of Minister for Development Cooperation and Humanitarian Affairs, M. Franz Fayot.