First, Do No Harm

Socially responsible, inclusive financial services should ultimately help clients to thrive—to meet daily needs, take advantage of opportunities, manage life’s risks, and pursue their dreams. But at a minimum, financial services should do no harm. Financial service providers have an obligation to ensure that their products and services avoid harming clients.

Twenty years of research and refinement of best practices in the inclusive finance industry have brought together 8 Client Protection Standards which ensure that financial services are delivered to clients in a safe, responsible, and fair manner. These standards are fully incorporated within the Universal Standards for Social and Environmental Performance Management.

Click each balloon for more information.

Appropriate Product Design and Delivery

The provider's products, services, and channels benefit clients.- Financial service providers pay adequate attention to product design and distribution channels, so as to ensure no harm is done to the clients.

- For the design of the products and distribution channels, the customer characteristics are analyzed, and client feedback used.

-

- Providers not only offer access to appropriate products and services, but also offer products that generate value for customers.

ESSENTIAL PRACTICES

-

The provider uses data to identify patterns of financial behaviour by client segment.

-

The provider collects client feedback on their experiences using the provider's products and services.

-

The provider uses insights from client data to design products, services, and delivery channels.

-

The provider's products, services, and channels protect clients from harm.

Prevention of Over-indebtedness

The provider does not over-indebt clients.- Over-lending is perhaps the client protection problem most likely to cause significant harm, both to individual clients and to providers.

- The entire credit process needs to be designed with carefully defined and rigorously evaluated criteria: eligibility criteria and acceptable debt thresholds.

- There must be a rationale for target setting and incentive schemes that considers the market potential and unintended consequences, and senior management must monitor and respond to portfolio quality issues.

-

- Studies and practical experiences show that clients generally overestimate their ability to repay debts.

ESSENTIAL PRACTICES

-

The provider makes loan decisions based on a client's repayment capacity.

-

The provider monitors the market and responds to heightened over-indebtedness risk.

-

The provider's strategic and/or business plan establishes responsible growth targets.

-

During times of high growth, the provider monitors more frequently data related to responsible growth.

3. Transparency

The provider gives clients clear and timely information to support client decision making.- Financial service providers must communicate clear, sufficient, and timely information in a manner and in a language that customers can understand, so that they can make informed decisions.

- There are 2 sides to the transparency coin:

-

- Disclosure of relevant information

- Ensuring that information is disclosed in a manner that alows the customer to understand it

- Transparency is a prerequisite for a responsible price!

ESSENTIAL PRACTICES

-

The provider is transparent about product terms, conditions, and pricing.

-

The provider communicates with clients at appropriate times and through appropriate channels.

4. Responsible Pricing

The provider sets prices responsibly.- Prices and fees are set in a rationale way considering internal and external factors.

- Providers strive to avoid transferring unnecessary costs to clients and disclose transparent prices.

-

- uPrices are set to be affordable to clients and sustainable for the institution. Profits are necessary to continue serving clients, but are not an end in itself.

ESSENTIAL PRACTICES

-

The provider charges fair prices.

-

The provider charges reasonable fees.

-

The provider does not transfer unnecessary costs to clients.

5. Fair and respectful treatment of clients

The provider enforces fair and respectful treatment of clients.- Providers and their agents treat clients fairly and respectfully, as defined in the institution's code of conduct.

- They do not discriminate in either client selection or treatment,

- Providers ensure adequate safeguards to detect and correct corruption and aggressive or abusive treatment by staff and agents, particularly during sales and debt collection.

-

- Respectful treatment is particularly important to maintain during loan collection, when clients are sometimes perceived as no longer deserving of respectful behaviour.

ESSENTIAL PRACTICES

-

During the recruitment and hiring process, the provider assesses each candidate's commitment to achieving the provider's social goals and serving its target clients.

-

The provider's code of conduct requires fair and respectful treatment of clients.

-

The provider does not use aggressive sales techniques.

-

The provider protects clients' rights to respectful treatment during the loan collection process.

6. Privacy of client data

The provider secures client data and informs clients about their data rights.- The privacy of client data is respected. Providers will only use customer data for authorized purposes and with the client’s consent.

- Establish systems to prevent client data from being improperly disclosed or used incorrectly, and to protect clients from fraud. (whether by staff, agents, partners or bad actors)

-

- There is great liability and reputational risk for not doing this well! Clients entrust financial service providers with highly sensitive data

ESSENTIAL PRACTICES

-

The provider maintains the security and confidentiality of client data.

-

The provider informs clients about data privacy and data rights.

7. Mechanisms for complaints resolution

The provider receives and resolves client complaints.- Providers have a mechanism to collect, categorize, analyze, and respond to customer complaints in a timely and efficient manner.

- This mechanism is accessible and adapted to clients needs.

- It is used to improve the quality of products and services.

-

- Satisfaction surveys are not a substitute for a complaints mechanism.

ESSENTIAL PRACTICES

-

The provider has a complaints mechanism that is easily accessible to clients and adapted to their needs.

-

The provider resolves complaints efficiently.

-

The provider uses information from complaints to manage operations and improve product and service quality.

8. Governance & HR

The governance and management are committed to Client Protection, and HR systems support its implementation.- Client Protection is a concern at the highest level of the provider’s governance and strategic decisions are driven by CP data.

- Senior Management closely monitors client protection risks and takes corrective actions.

- Management systems support client protection implementation through training, incentive schemes, reporting and controls.

ESSENTIAL PRACTICES

-

The board makes strategic decisions based on social and financial data.

-

Management makes strategic and operational decisions based on social and financial data.

-

The provider trains all employees on its social goals and on client protection.

-

The provider evaluates and incentivizes employees based on social and financial criteria.

Client protection is not the whole story of social and environmental performance management—but it is a minimum moral obligation for every financial service provider and for the investors who support those institutions.

Focusing business strategy towards clients increases their trust and loyalty. And client protection lays the foundation for a prosperous market and ensures the well-being of all customers in financial value chains.

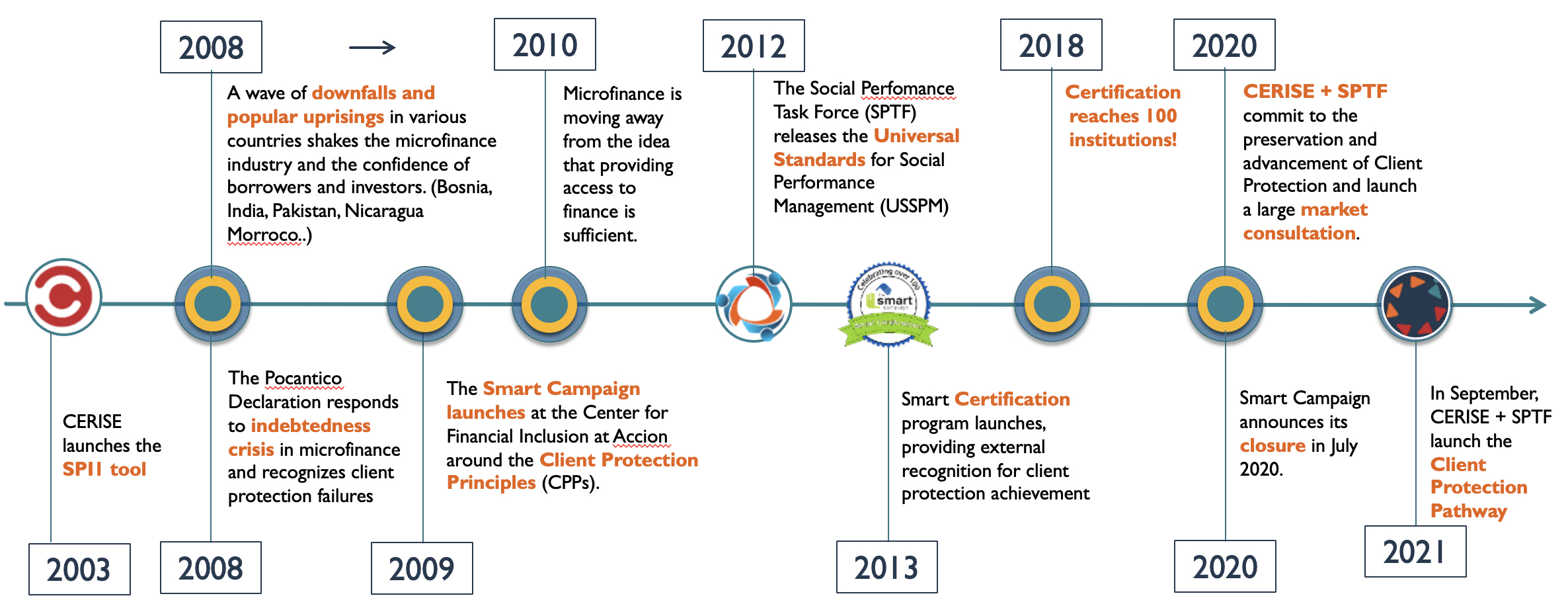

Brief History

From its origins in the early 1970s, responsible inclusive finance (better known then as microfinance) claimed to have a double bottom line: a social mission as well as a business case. Significant donor and investor funding, as well as public goodwill, was mobilized on that basis. But because there were no clear, universally accepted standards about how to measure social performance and protect the interests of low-income, vulnerable clients, the global state of practice was uneven. By the mid-2000s, it was obvious that good intentions were not enough. A series of client-protection initiatives got underway, culminating in the 2021 launch of the Client Protection Pathway, under the leadership of Cerise+SPTF.

2003

CERISE launches the SPI1 tool

2008

A wave of downfalls and popular uprisings in various countries shakes the microfinance industry and the confidence of borrowers and investors. (Bosnia, India, Pakistan, Nicaragua Morroco..) The Pocantico Declaration responds to indebtedness crisis in microfinance and recognizes client protection failures

2009

The Smart Campaign launches at the Center for Financial Inclusion at Accion around the Client Protection Principles (CPPs).

2010

Microfinance is moving away from the idea that providing access to finance is sufficient.

2012

The Social Perfomance Task Force (SPTF) releases the Universal Standards for Social Performance Management (USSPM)

2013

Smart Certification program launches, providing external recognition for client protection achievement

2018

Certification reaches 100 institutions!

2020

Smart Campaign announces its closure in July 2020.

Cerise+SPTF commit to the preservation and advancement of Client Protection and launch a large market consultation.

2021

In September, Cerise+SPTF launch the Client Protection Pathway

2022 and Beyond

Cerise+SPTF continue to pursue a series of initiatives aimed at raising awareness and uptake of client protection.

The global community of stakeholders who are serious about building a better future for clients continues to grow.