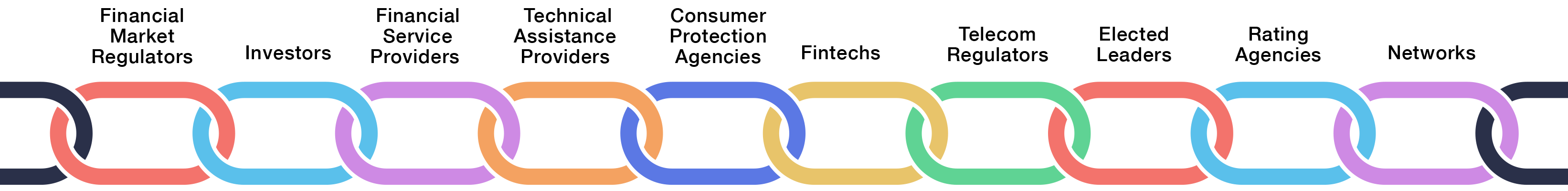

A chain is only as strong as its weakest link.

The value chain of financial services is no exception.

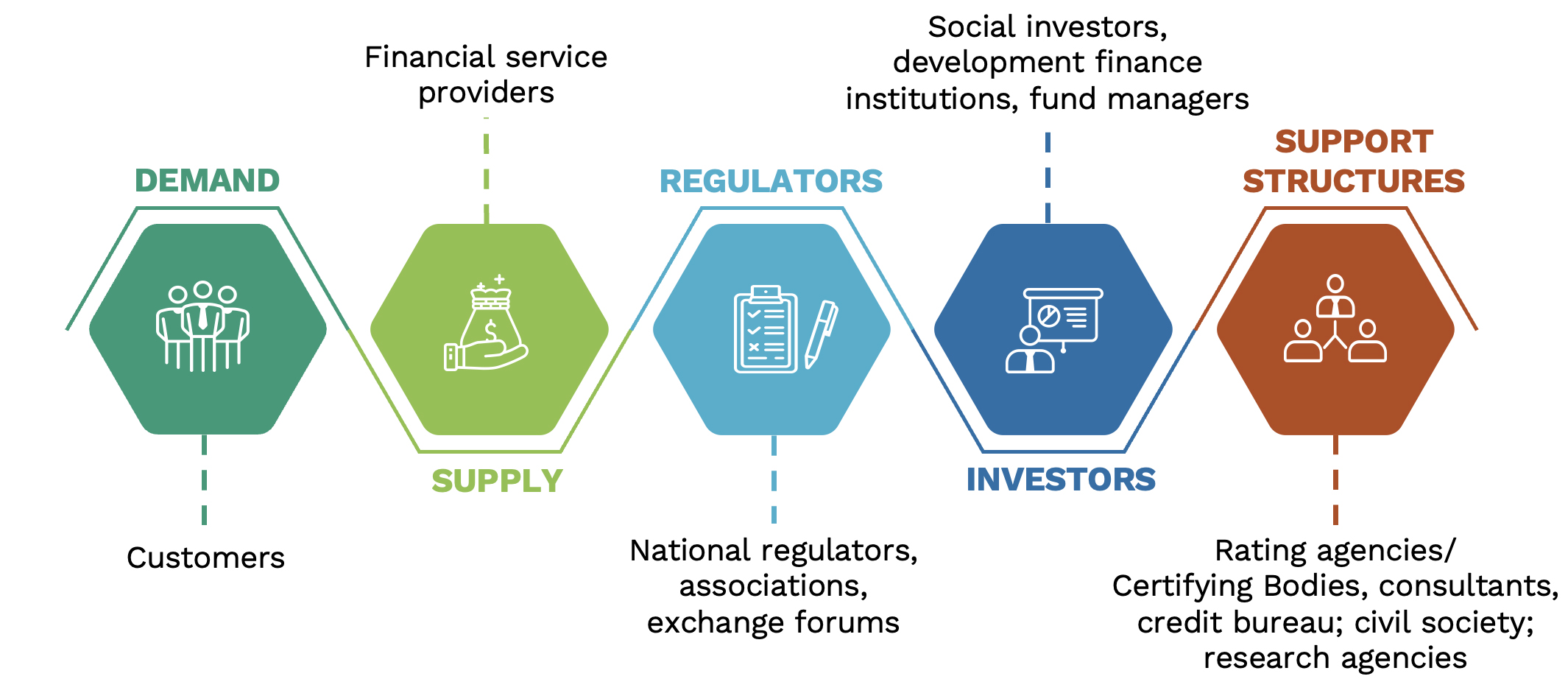

For responsible inclusive finance to fulfill its promise—empowered customers using safe, affordable, convenient, and effective financial services to seize opportunities and manage risks—all the actors in the chain must do their parts. It is not enough for consumers to be financially literate if they have no access to appropriate services. It is not enough for financial service providers to have good intentions if they lack tools to translate those intentions into strong social and environmental performance. It is not enough to have strong regulatory frameworks without rating agencies to assess providers’ compliance.

Cerise+SPTF works on all fronts at once.

Demand side

Supply side

Our signature product, the Universal Standards for Social and Environmental Performance Management, is the roadmap for financial service providers to turn their good intentions into actions—and impact. Financial service providers work towards applying the Standards, and we work continually on tools that help that process.

Regulators

We provide strategic counsel to strengthen regulation on client protection. We also share global best practices on regulation and client protection. Multiple regulators have adopted our standards and indicators in their supervision tools.

Investors

Ensuring that their partners and clients are implementing the accepted global standards via the use of covenants. Our Social Investor Working Group, or SIWG, consists of the leading impact investors in inclusive finance.

Support

Cerise+SPTF maintains the SEPM Pros network of qualified experts to help financial service providers in implementing social and environmental performance management, and chart the path to success. Cerise+SPTF manages facilities to co-fund projects, and oversees the methodology for the Client Protection Pathway.