Resources for Every Step of the CP Pathway

The Pathway gives providers a roadmap for implementing the Client Protection Standards, one step at a time, and helps them stay on track, while getting public exposure.

Step 1: Commit to implement client protection.

We ask financial service providers join the Client Protection Pathway by signing their commitment to implement the Client Protection Standards. The commitment statement is: “Our organization has reviewed the Client Protection Standards and we commit to using them to improve our practices over time.”

Getting started is simple! Complete the short inquiry form on this page. We will send you an email with information on how to create your profile on our website.

Because we consider that disclosure of the state of practice of an organization is an important step to substantiate the commitment to implement, each organization’s profile lists their completed client protection assessments, and/or certification achievement. We also ask providers to disclose the names of any client protection assessments they have undertaken in the last three years (since 2018) so that we can disclose its name and date. These assessments are available upon request by using the contact information listed in the organization’s profile.

By joining our pathway, you will be able to:

- Demonstrate your commitment to client protection.

- Get started with an assessment of your state of practice.

- Have a clear roadmap for what to do next.

- Be part of a community of like-minded organizations and experts.

- Access dozens of resources and case studies.

- Attend trainings and webinars and keep up-to-date with industry trends.

When you join the CP Pathway, we will put your institutional profile on our webpage. This is an opportunity for funders, potential partners and other stakeholders such as regulators, to easily identify your organization as a committed financial service providers.

Step 2: Assess and improve practices

In this step, FSPs create and implement an action plan based on an assessment towards of their client protection practices. Use this simple decision tree to help your organization decide how to jump into this step.

An assessment is an important first step in creating an improvement action plan. The following assessments tools are great options for financial service providers:

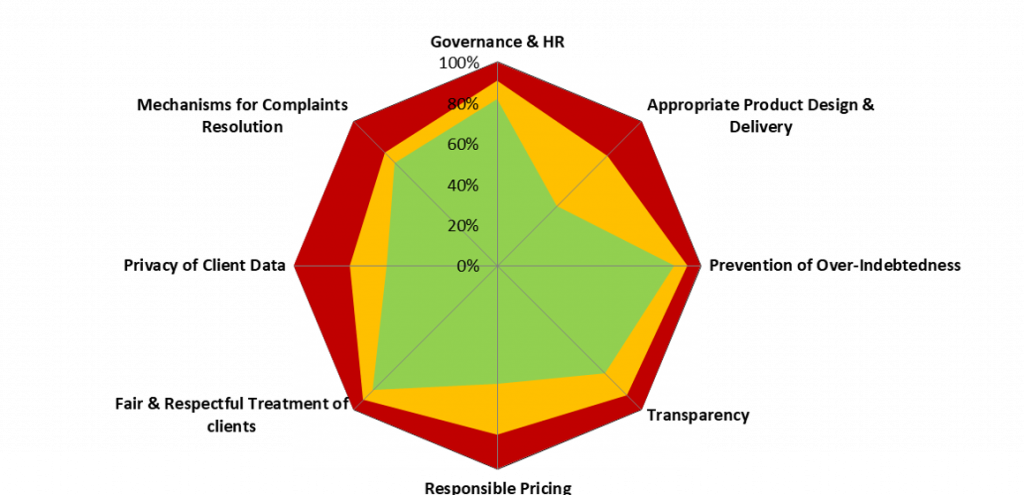

The Client Protection Self-Assessment Tool is an Excel-based assessment that generates scores for each of the seven Client Protection Standards. This is a great option for FSPs who want to understand the client protection framework and to conduct a self-evaluation of their client protection practices. Watch a short video explaining how to use the CP Self-Assessment Tool.

Results generated by the CP Self-Assessment

If you would like to have a third-party opinion on your client protection practices, you can also have an external assessment conducted by experts from our SPM Pro Network. Although the client protection standards have been updated since the Smart Campaign closed, these consultants are well-versed in client protection issues and can help you improve practices as you move along the pathway.

The SPI Online is an online tool that assesses an FSP’s social performance management (SPM) practices. This is a great option for FSPs who want to evaluate their client protection practices plus a larger set of SPM practices. It provides a more complete picture of an organization’s client centricity.

A social rating is an expert opinion on an FSP’s capacity to put its mission into practice and achieve social goals. This is a great option for FSPs who want a comprehensive, external review of their SPM practices.

There are many resources available to your organization to improve your practices.

After your assessment, create an action plan for improving your practices. Here’s an example action plan and a template for creating your own plan.

Check out the CP Implementation Series webinars and the Cerise-SPTF Resource Center to upgrade your client protection practices.

The Universal Standards Implementation Guide provides practical, actionable guidance for improving every aspect of client protection (see Dimension 3, 4 and 6).

If you need Technical Assistance for your improvement plans, check out our SPM Pro Network!

Step 3: Demonstrate progress and achievements.

Financial Service Providers seek certification from an approved certification body.

Client Protection Certification provides an independent and objective opinion on the implementation of a set of policies and operational practices considered necessary to provide adequate standards of care to protect financial services clients and avoid harming them.

Cerise+SPTF worked with rating agencies and sector experts to have developed a new client protection certification framework. This evaluation methodology is based on the Client Protection Standards and offers a tiered system for awarding certification. This means that it is no longer a pass/fail award, rather, certification is awarded on three levels: gold, silver, and bronze. Click here to read more about the new certification methodology.

In May 2021, Cerise+SPTF began approving organizations to conduct client protection certifications. An “approved certification body” is a structured and registered organization that has robust systems to ensure impartial decision-making and capacity to perform client protection certifications, and whose client protection certification methodology is aligned with the Universal Standards. This ensures the quality and comparability of the results of certifications.

Please note that Cerise+SPTF approve certification bodies (organizations) we do not oversee or approve the individual certifications of financial service providers. This remains under the responsibility of the approved certification bodies.

If you are seeking a Client Protection Certification, you can contact directly the following organizations who are currently approved by Cerise+SPTF:

Questions? Contact us!

Provisional status for 2023 with oversight and training from Cerise+SPTF

Provisional status for 2023 with oversight and training from Cerise+SPTF